Institutional Investors In The Single Family Rental Home Market

There is no doubt that we have an affordable housing crisis in America. This is not a new problem, but it’s gotten worse over the past decade.

The COVID pandemic poured gasoline on this fire – in 2020, people fled cities looking for more space in suburbia, new home building slumped, and the eviction moratorium reduced supply. The result is that today, in Westchester County, across New York State and nationwide, we continue to see rising demand and higher housing prices – the classic seller’s market.

A notable factor in this single family home price surge is institutional buying. There are 128 million households in the USA – 62% are owner-occupied, and 38% are rented. Of the 49 million rental units, 35% are single family homes, 62% are apartments, and 4% are mobile homes. Institutional investors account for 300,000 of the 16 million or so single family rental homes in our country.

At first glance, 300,000 out of 16 million is not a large percentage. Clearly, small landlords still dominate the single family rental market. The issue is that the number of corporate owned single family homes is rising faster than the proverbial river in flood.

It does not take a Ph.D. in Economics to figure out why companies like BlackRock (dba Invitation Homes), Waypoint, American Homes 4 Rent, and many more are buying single family homes in record numbers. Institutional investors chase yield, or the “interest” (if you will) they make on their money. In 2021, single family homes are a very attractive investment. Why? Because not only can you make high yield returns from rental income, the value of the underlying property continues to rise, potentially for some time to come.

What’s “wrong” with institutional investors buying large numbers of single family homes? Potentially, several things. But let’s start with what’s “right” about this trend.

If I’m an individual REI and I own a single family home, or a few single family homes, then more buyers means the value of my property rises. If I’m a renter looking for a single family home, institutional investors increase supply because they purchase inventory from owner occupied homes and convert them into rentals (at least with most of their purchases). Higher prices, more inventory – that’s potentially good news for small REIs and renters.

But there’s a downside.

Homeownership has historically been the most effective way for families to build wealth in America. While real estate prices rise and fall (like all markets do), owning property has been the surest path to building wealth and achieving the American dream.

Today, we have millions of younger Americans eager to buy their first home. But, with supply already low, institutional investors are crowding out these younger buyers by outbidding them for homes and driving prices higher.

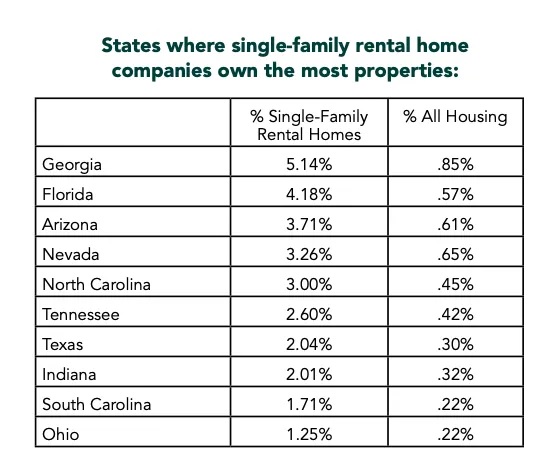

While institutional investors are buying more single family homes, their overall ownership percentage in the rental market remains low. Here’s a chart from Vox that illustrates this point:

Also, plug this into the mix – if institutional investors become a larger component of the single family rental housing market, their buying power could stabilize prices when, inevitably, the housing market takes a downturn. Less cyclicality is a good thing. Remember 2008?

Wall Street buying more homes on Main Street makes people nervous, and not without some justification. This leads to news coverage portraying institutional investors as “Greedy Fat Cats” determined to scoop up all the inventory and force a “rental boom” – Fox Story on rental housing.

The bigger question that has to be addressed is the need for more affordable housing. Here’s a quote from an article in Vox on how Wall Street investors might impact the single family rental housing market over time –

Even if institutional investors are competing with homeowners for existing homes, that doesn’t mean they’re just taking a home off the market — it simply means they are converting it to a rental property. Since renters are on average less wealthy than mortgage-qualifying would-be homeowners, institutional investors might be creating more housing for lower-wealth Americans. Traditionally, there have been no single-family rentals in desirable neighborhoods, which has made it impossible for less well-off people to live in them. That could start to change.

Institutional investment in the single family rental market is rising. Like most market trends, there are pluses and minuses. For now, the number of corporate owned rental homes is not large enough to warrant a “market takeover” discussion, but it bears watching over the coming months and years.

Sterling Property Solutions’ clients rely on us to handle all aspects of the property management equation. Most of them are busy people, with businesses and careers that require their full attention. They want to be involved and stay informed, but they also know that they do not have the time or expertise necessary to be hands-on landlords.

Our team can answer all of your property management questions and help you address any challenges. Please give us a ring at 914-355-3277 or send us an email at [email protected].